They say being an OFW is not forever. That’s true. There will come a time when you need to go back home and look for another opportunity to work abroad and sustain your family and their needs. There are also instances when you need to go back home due to existing conflict in the country where you’re working or you will be sent back home due to unforeseen circumstances.

This is why it is important to have an emergency fund – to help you start from something due to events that you didn’t see coming.

Read on to find out everything you need to know about emergency fund, plus tips on how to set it up.

What is an Emergency Fund?

As the name suggests, an emergency fund is an account specifically for unforeseen, unplanned situations. These situations could be a major illness, loss of job, or a major expense. Experts suggest that regardless of your socio-economic class, everyone needs an emergency fund because you will never know what will happen.

There are various channels that could help you set up your emergency account. You can open a savings or checking account specifically for that purpose, money market account, or even keep money in a safe (although this is not advisable due to proximity and convenience).

Tips on How to Set Up Your Emergency Fund

1) Think ahead. The purpose of an emergency fund is to ensure that you have something to sustain you for the next few months until you are able to get back on your feet. In setting up your emergency fund, make sure to think ahead. Imagine much it would be, the amount you need to allocate every month, and how long your fund will last (preferably at least six months) and work for it.

2) Make it liquid and accessible. Emergency fund is used for emergency purposes. Therefore, it should be liquid and accessible. Savings or checking account is the most feasible option since both are highly liquid and can be withdrawn easily.

3) It should be automatic. In order to make it work, your emergency fund must be filled regularly. Make your contributions automatic and pay for the amount lost in case you forgot to deposit on certain months. If you can enroll your emergency fund account in online banking, then link it with your other accounts to make transfer easier.

4) Maximize loose change. Only few people would love to carry around a bag full of coins. Make use of those loose change by adding them in your emergency fund. You might even be surprised with how much money these coins could add in your account.

5) Evaluate spending choices. Do you really need to open all the lights when you’re sleeping? Do you always order more than what you can consume and finish in restaurants? How many times do you have to take the cab than ride the train or walk? These simple acts seem harmless, but you end up paying more. Take a look at your spending and lifestyle habits, get rid of wasted money, and contribute it in your emergency fund.

More importantly, let your emergency fund be. Let this fund serve its purpose and don’t use the money to cover for your family’s material expenses.

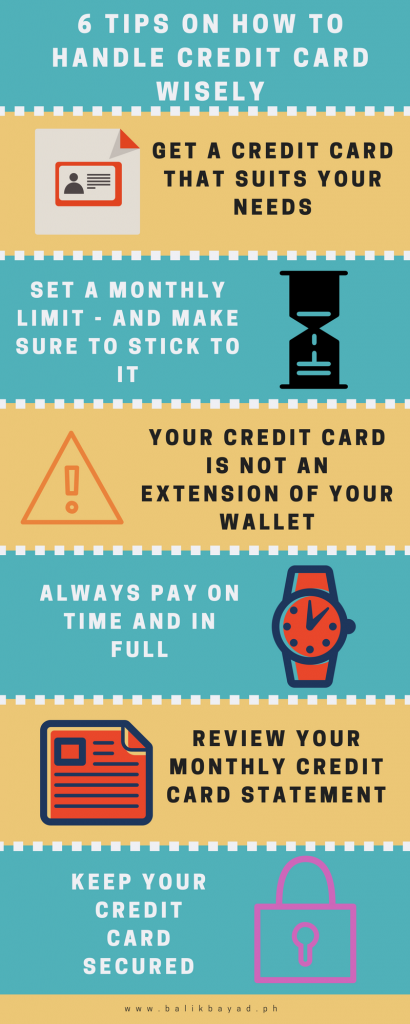

Tip No. 1: Get a credit card that suits your needs.

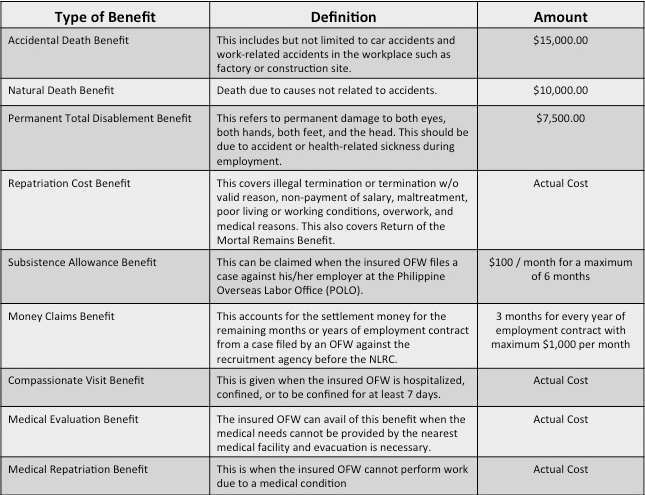

Tip No. 1: Get a credit card that suits your needs.  5. Here’s how to file a claim for Agency-Hired OFW Compulsory Insurance:

5. Here’s how to file a claim for Agency-Hired OFW Compulsory Insurance: Who doesn’t need money? Regardless of the currency of the money you are earning, everybody needs cash to pay for the rent, buy food for the table, and send the kids to school. Because of this need for cash, banks and other lending institutions came up with different facilities that will suit your specific needs.

Who doesn’t need money? Regardless of the currency of the money you are earning, everybody needs cash to pay for the rent, buy food for the table, and send the kids to school. Because of this need for cash, banks and other lending institutions came up with different facilities that will suit your specific needs. Being single and in your 20s may be the best time of your life. You can do anything you want and not worry about anything. Apparently, if you are one of the thousands of Filipinos working overseas to help provide a better life for your family, then being single and in your 20s calls for bigger responsibilities. In fact, you hold the title of being the “breadwinner,” who constantly have to send money for your siblings’ tuition fee or your father’s medication.

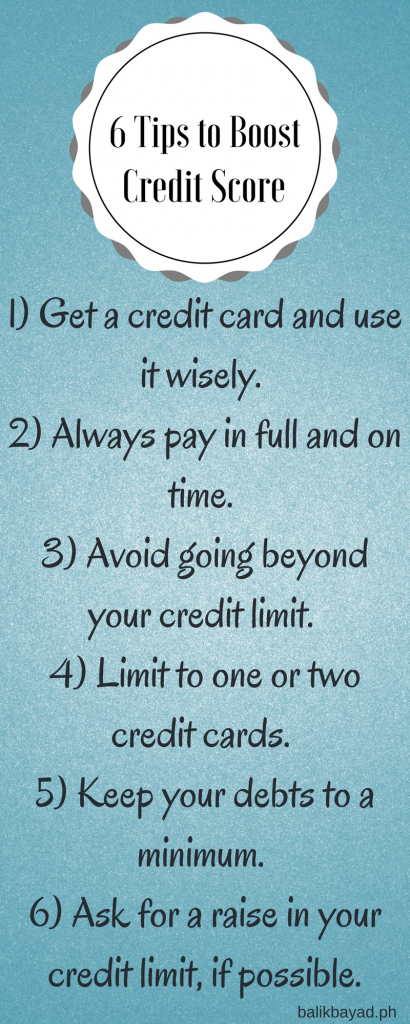

Being single and in your 20s may be the best time of your life. You can do anything you want and not worry about anything. Apparently, if you are one of the thousands of Filipinos working overseas to help provide a better life for your family, then being single and in your 20s calls for bigger responsibilities. In fact, you hold the title of being the “breadwinner,” who constantly have to send money for your siblings’ tuition fee or your father’s medication. 1) Get a credit card and make sure to use it wisely.

1) Get a credit card and make sure to use it wisely.