Everybody wants a good, reliable, and trustworthy lenders. You want to make sure that we get the right treatment and service. After all, you are helping them earn, right?

Here’s the thing: lenders want good, reliable, and responsible borrowers too. This explains why credit standing is very important. It is the lender’s way of determining how responsible you are in paying your financial obligations. If you are serious about proving your worthiness, you need to possess the following qualities:

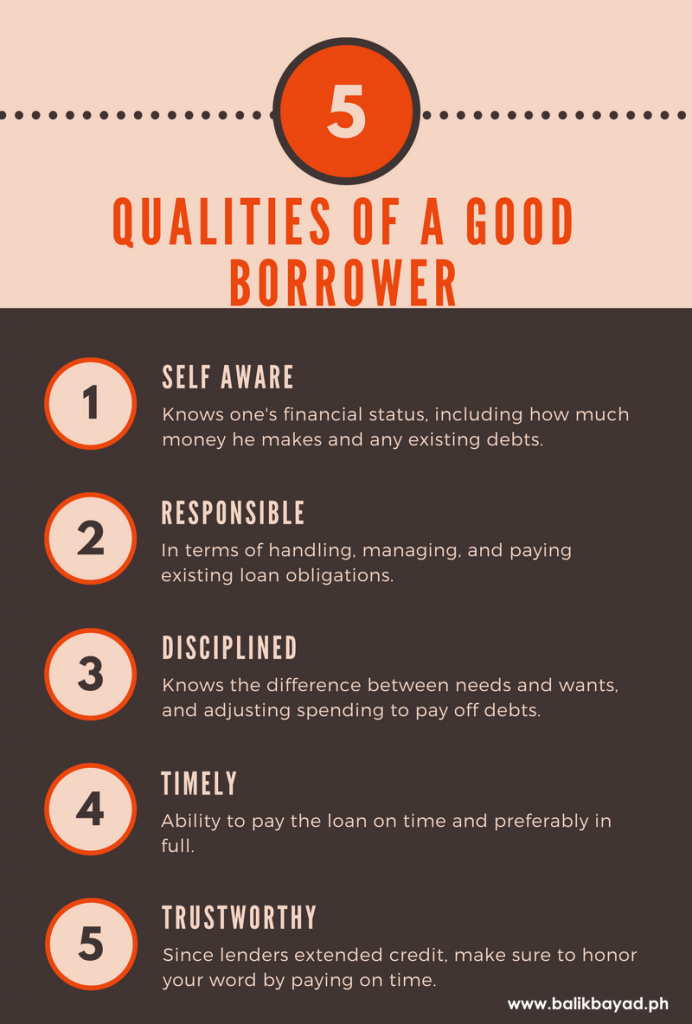

1) Self-awareness

If there is anyone who knows you better, then that is you. Being a good borrower entails self-awareness, especially in terms of financial aspects. You should be aware of how much money you are making, the areas you need additional help, and the amount of money you currently have. Before you apply for any loan, make sure you look into your financials first and determine whether you really need additional funds or not.

2) Responsible

Nothing would make lenders happy than having a responsible borrower. It doesn’t matter how much money you borrowed. Banks would like to see that you are willing to take responsibility of your obligations and how you handle your loans, whether past or current ones, is a testament to that.

What does it take to be a responsible borrower? Apart from being organized, being a responsible borrower also means finding ways to overcome struggles instead of using these personal issues as an excuse to default in payments. Don’t use the “delay in remittance” excuse, too.

3) Disciplined

Aside from being responsible, a good borrower is also a disciplined borrower. You know whether or not you need credit by differentiating needs from wants. You are also a disciplined borrower by taking note of your expenses, not giving in to requests from your extended relatives, saving for things that matter, and finding areas you can cut back in order to pay for your existing loan obligations.

4) Timely

You know what your obligations are and even willing to cut back on certain expenses to be able to pay the loan obligation. Still, this doesn’t end there. You need to be able to pay on time, whether paying amortizations or the full amount of the loan, in order for banks to consider you as a good borrower.

5) Trustworthy

You want to get a loan from someone you can trust. In return, lending companies want borrowers who they can trust as well.

Lenders extended credit at your disposal. Make sure to pay them back on the agreed time. The next time you needed funds, they will be glad to help you again.

With these qualities, are you a good borrower? If yes, then keep it up. If not, then don’t worry. You still have time to adopt these qualities and turn yourself into a good, if not great borrower.