Being an OFW is a sacrifice. You have to leave your family behind for at least two years to be able to give them a better and more secured life. This includes food on the table, bills being paid, education for your kids, and of course, a house you can call your own.

Buying your own house can be heavy on the budget, which is why many OFWs take advantage of PAG-IBIG’s Housing Loan Program. Compared to the housing loans offered by banks and other financial institutions, PAG-IBIG has lower interest rate for easier repayment scheme.

Unfortunately, Covid-19 happened. This prompted hundreds of thousands of Filipinos to go back home while there are still thousands more who cannot go back for variety of reasons. By going home, this means leaving your work that could greatly affect your cash flow. This could be a cause of concern especially if you have pending loans such as housing loan.

If you coursed your Housing Loan with PAG-IBIG, then there’s good news for you. PAG-IBIG is now offering a more affordable monthly amortization and payment relief through the Home Loan Restructuring Program.

Here’s what you need to know about it:

What is the Special Housing Loan Restructuring Program?

This program is offered by PAG-IBIG to all its Housing Loan borrowers who were greatly affected by the pandemic. Through the restructuring program, borrowers can enjoy:

- Extended loan term

- Lower monthly interest rate

- Delayed payment for the principal loan amount, which can be paid towards the end of the loan term

- Waiver of penalty charges imposed on unpaid monthly amortization

- Payment relief, which means borrower can opt to start paying the loan anytime between December 2020 and March 2021

Through this program, borrowers will have a lower risk of losing the house.

In case you’re interested of buying a property from any PAG-IBIG Fund acquired asset, you can also apply under the Restructuring Fund.

Features Of Special Housing Loan Restructuring Program

- Unpaid amortizations will be carried over and made part of the restructured loan

- Interest rate of 6.375 percent per annum for three years

- Loan term of up to 30 years, as long as the principal borrower does not reach the age of 70 by the time the loan matures

- No documentary requirements needed for submission

- No processing fee

- No downpayment

- The program comes with Mortgage/Sales Redemption Insurance and Non-Life Insurance, which serves as a guarantee of payment in case something happens to the principal borrower. Take note that the borrower must pay an equivalent of one year premium within 30 days from the time the loan application is approved.

- Can be applied to more than one PAG-IBIG Housing Loans

Who can apply?

The Special Housing Loan Restructuring Program is open to all PAG-IBIG Housing Loan borrowers with unpaid monthly amortizations of up to 12 months by August 2020. This means if you were not able to pay the monthly amortization for 13 months and above, then you cannot qualify for this service.

Also, borrowers with cancelled PAG-IBIG Housing Loan or the property was already foreclosed or a subject of litigation cannot apply for this program.

How To Apply

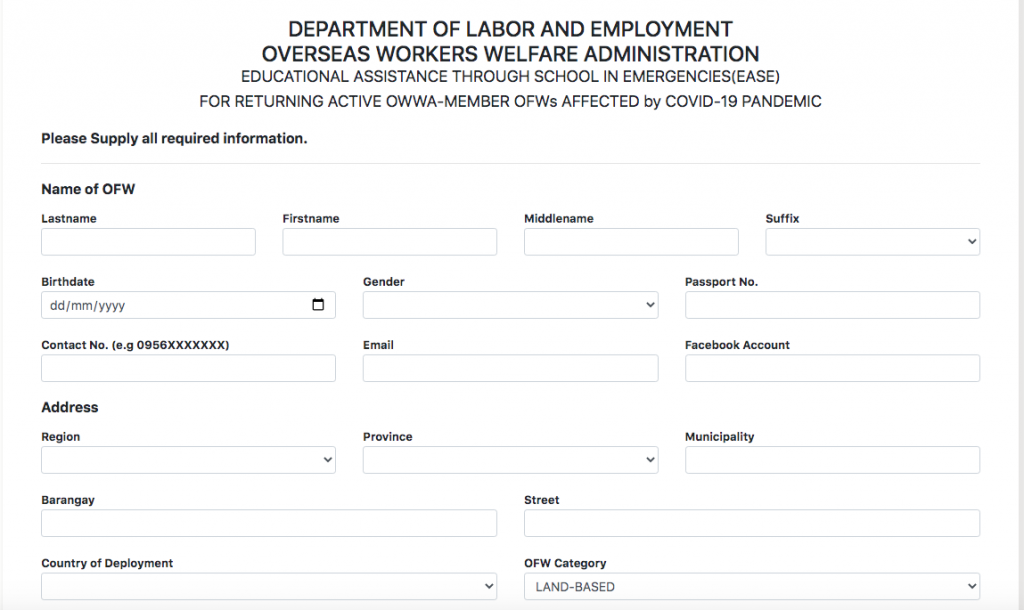

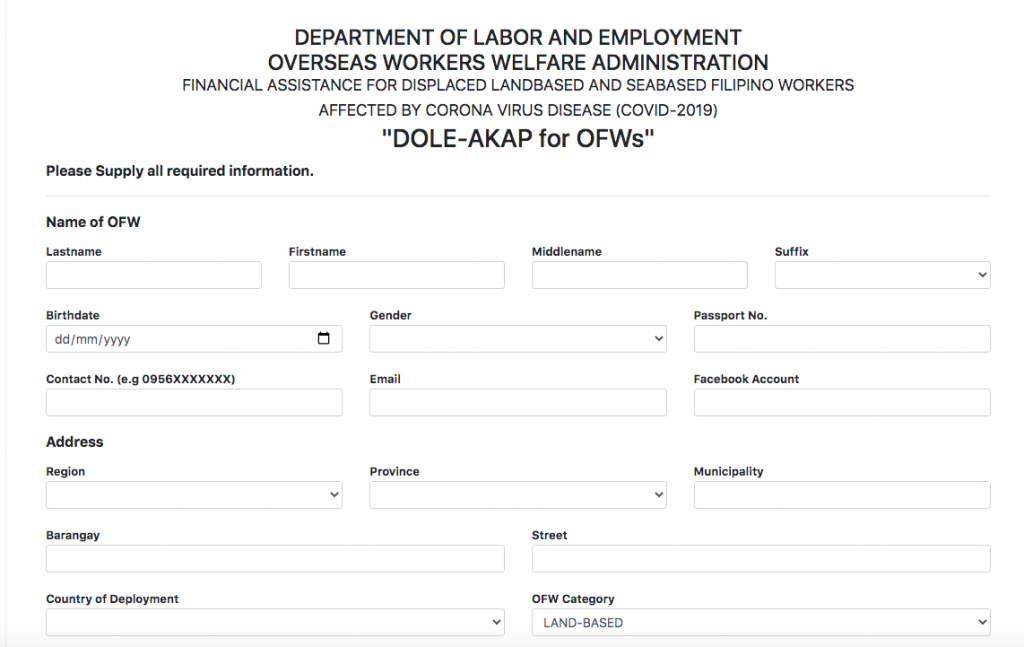

To apply for this program, you can visit the Virtual PAG-IBIG website, which you can also access here. For OFWs, you can access the website here. The online process will be safer, faster, easier, and more secured.

After filling out the necessary information, you will receive a Reference Number, which serves as proof that the agency received your loan application. Keep this since you can use this to check the status of your loan application.

If approved, you will receive a text or email message saying that your loan application is approved. Make sure that your email address and mobile message are active.

What happens if your application is denied?

Don’t worry. PAG-IBIG offers the following programs to help their borrowers settle unpaid amortizations, update their status, and reduce the risk of losing their home:

- Regular Housing Loan Restructuring Program

- Non-Performing Asset Resolution Program

- Plan of Payment

Make sure to avail of this program to enjoy payment relief offered by the agency. As per website, PAG-IBIG will accept applications until December 15 only.