Have you tried applying for a loan? As a rule, the applicant is the principal borrower where the loan will be coursed through, unless otherwise stated.

Let’s say that you are already 60 years old or you have unstable income at the time you applied for a loan. Lending companies don’t discriminate based on age or the income bracket you belong to, but they will require you to have a co-maker, preferably your sibling or child above 18 years, to apply for a loan and improve your chances of approval.

What is a co-maker? What are the responsibilities of being a co-maker? Will he or she be liable to pay for the loan too? Read on to find out.

Understanding Co-Maker a Little Bit Better

By definition, co-maker is a person who, by virtue of contract, promises to pay the loan of another in case of default. He or she is often used when you apply for a collateral loan and when the borrower is unable to meet certain credit criteria such as age or insufficient proof of income. By having a co-maker, you can increase the amount of loan and boost chances of approval, especially if the co-maker is in good credit standing and has sufficient income.

As a co-maker, he or she does not receive or benefit from the proceeds of the loan. Nonetheless, one is responsible in ensuring that the full amount of the loan including interests are paid.

Assuming that you defaulted payment and your co-maker was made to pay the loan. Does he or she have any right of reimbursement from you? The answer is yes. The co-maker can demand reimbursement from the principal borrower for all the payments made in relation to the loan.

Co-Borrower versus Co-Maker

Don’t mistake co-maker with co-borrower. The nature may be the same, but a co-borrower is more common on non-collateral loan and often billed to pay for the monthly loan amortization in case the principal failed to make any payment.

In other words, the obligation to pay commenced at the start of the loan and has benefitted from the proceeds.

Various Reasons Why You Need a Co-Maker:

- To assure lenders that the loan will be paid no matter what happens

- Get a higher loanable amount

- Improve chances of loan approval despite limited to no income or low-value collateral

- Gain the lender’s trust, which could potentially improve your credit standing

- Additional assistance to pay the loan amortization

- Prevent foreclosure of your property in case you are unable to pay your loan

The key is to choose a co-maker that has a stable source of income and with good credit standing. Unfortunately, not everyone are willing to be a co-maker. Even if someone can back you up to pay for your loan, make sure to do everything that you can to fulfill your loan obligations and don’t pass the burden to someone.

Check out this reminder to the public posted by Bangko Sentral ng Pilipinas regarding being a co-maker.

Who doesn’t need money? Regardless of the currency of the money you are earning, everybody needs cash to pay for the rent, buy food for the table, and send the kids to school. Because of this need for cash, banks and other lending institutions came up with different facilities that will suit your specific needs.

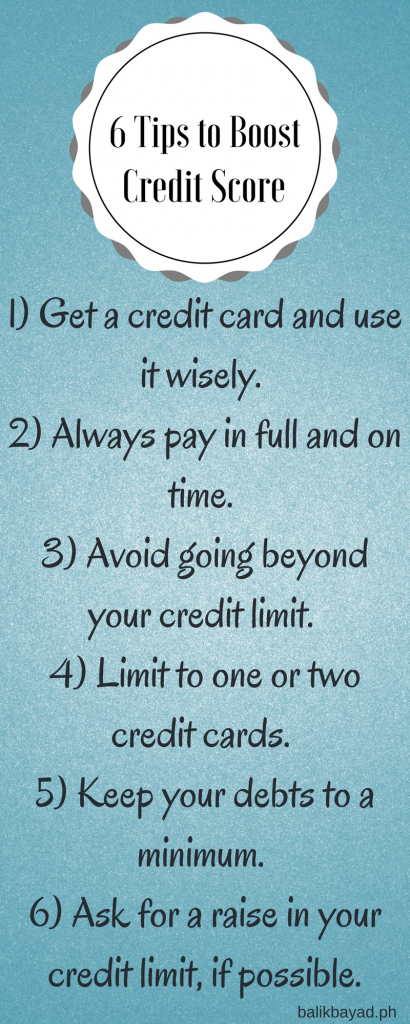

Who doesn’t need money? Regardless of the currency of the money you are earning, everybody needs cash to pay for the rent, buy food for the table, and send the kids to school. Because of this need for cash, banks and other lending institutions came up with different facilities that will suit your specific needs. 1) Get a credit card and make sure to use it wisely.

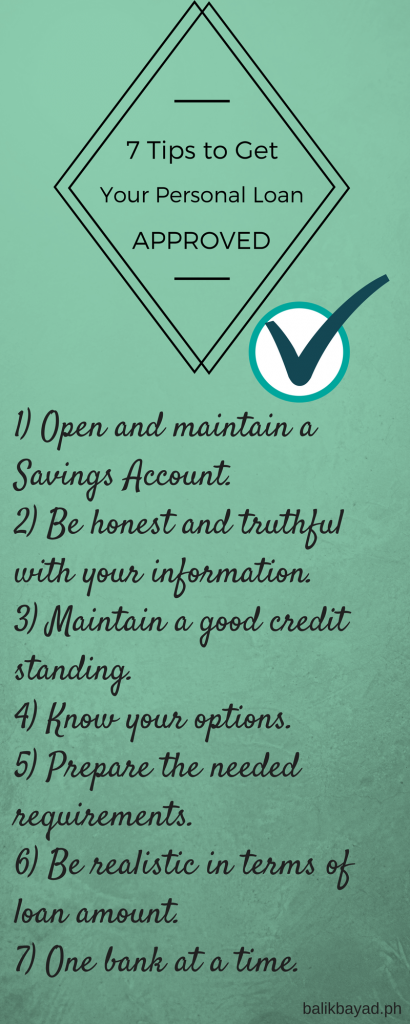

1) Get a credit card and make sure to use it wisely. 1. Open and maintain a savings account.

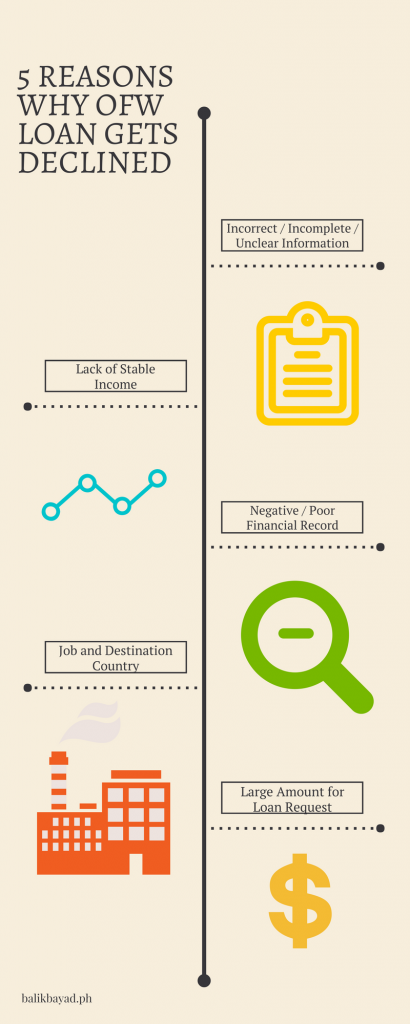

1. Open and maintain a savings account.  1) Incorrect / Incomplete / Unclear Information

1) Incorrect / Incomplete / Unclear Information