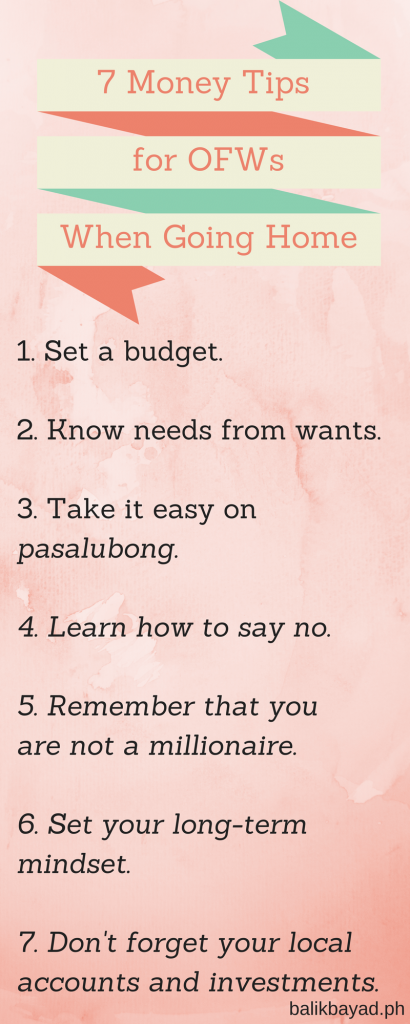

One of the most awaited events for every OFW family is when you go home, especially if its been years since you last set foot in the country. Whether it’s a one-week or one-month vacation, going back home means nonstop eating, shopping, and catching up with friends and family. This also means the possibility of depleting your hard-earned money slash savings and going back to where you are working with almost nothing left in your pocket.

In case you are heading home, make sure you read these tips – and keep your finances in check:  1. Set a budget.

1. Set a budget.

This is the first rule every OFW must remember when vacationing.

Admit it. There is a tendency to splurge on your family member and give in to friends when you’re back home, especially if it has been years since they last saw you. Nevertheless, never leave without setting your budget. Set aside money and categorize them accordingly – shopping, dining out, quick vacation, and even last-minute or emergency expenses. More importantly, make sure to stick to it. This will help you limit your expenses and at the same time, prevent careless spending.

2. Know needs from wants.

Now that you are in the process of setting a budget, make sure you differentiate needs from wants.

You might be tempted to buy everything that you can before heading back to the Philippines. Before you make those purchases, stop, think, and decide whether your son really needs that new rubber shoes when you just sent him a new one a month ago. By differentiating needs from wants, you will be able to limit your spending and focus more on the non-material things. You’ll save your wallet, too.

3. Take it easy on pasalubong.

Every OFW is guilty on this. After all, giving pasalubong is part of the Filipino culture and at the same time, a love language.

Wait, do you really need to buy one for your friend’s niece or give something to your neighbor? As much as possible, limit pasalubong to immediate family members. You would be able to save a lot if you don’t let the pressure of giving something to everyone get in your head.

This leads you to the next tip.

4. Learn how to say NO.

Asking for pasalubong or making a list of bilin is common in Filipino society. Most of the time, pressure sets in and it’s hard for you to say “No” when someone asks for this and that.

At this point, learn how to say no. You don’t have to give in to everyone’s demands just because they helped you get a job overseas or your kumpare wants nightly drinking sessions in your honor. You can’t please everybody. If they can’t understand that you are in a tight budget, then it’s not your problem anymore.

5. Remember that you are not a millionaire.

Working overseas comes with many uncertainties. In an instant, political conflicts, natural calamities, or changes made by your employer could ship you back to the Philippines.

Therefore, don’t live like a one-day millionaire. Never splurge on something that you might regret later on. What you have is a product of your hard work and sacrifices abroad. Spend your money wisely.

6. Set your long-term mindset.

As harsh as it may sound, you are only as good as your employment contract. Once it’s done and your employer no longer extends your services, you have to face the consequences of going back to the Philippines and look for a new job to sustain the family.

This is why it is important to set your long-term mindset and goals. Instead of focusing on the present and sending money and material things to your family, make sure you are able to prepare for the future. You can’t work abroad forever, so as much as possible, save and invest.

7. Don’t forget your local accounts and investments.

Do you have local bank accounts? Before heading back to your work overseas, make sure you check your local accounts to see how money is being spent. This is a good opportunity to check any dormant accounts where you get charged with P200 or P300 dormancy fee every month. Checking on your investments, if any, is also a must to keep you updated of how much money you are able to grow.

If you don’t have a local account, then it is best to set up one (or two). Take your time home as an opportunity to study investment options to help you grow your money. This way, you are sure that you have something to lean on in case of emergency.

The time you spend with your family is worth more than the material things you give them. Focus more on things that matter without emptying your wallet. Working overseas is both a blessing and a privilege. Make use of it in the best way that you can without going bankrupt.